Support the Timberjay by making a donation.

Ely’s golden goose

Township residents power Ely-area economy

Editor’s Note: The following is an analysis of the potential economic risks associated with copper-nickel mining in the Ely area. It relies heavily on census data, county records, election results, and findings from a 2014 survey of residents in the townships surrounding Ely and looks primarily at income generated by local residents (whether permanent or seasonal), not outside visitors. It includes conclusions and assumptions which are presented within the narrative. We believe this is the best available data and that the assumptions are conservative. We hope this will add to the current debate over the wisdom of pursuing copper-nickel mining in the Ely area.

REGIONAL— An economic study released last month, commissioned by the Campaign to Save the Boundary Waters, suggests that thousands of jobs could be lost across the Arrowhead were a copper-nickel mine built on the edge of the canoe country.

As the Timberjay reported at the time, one potential weakness of the study is its assumption that the negative impacts that a mine would likely have on what it terms the “amenity-based” economy could be extrapolated across all of St. Louis, Lake, and Cook counties, including the city of Duluth. Using that approach, the study’s authors estimated potential job losses that were extremely high, as many as 22,000 across the region and a loss of $1.6 billion in annual income.

At the Timberjay, we see numbers that high as unrealistic, primarily because it is unreasonable to project similar economic impacts across the entire Arrowhead from mining in the Ely area. Residents in Duluth, for example, would see few of the new jobs created by a potential new mine, nor would they see many of the potential job and income losses that could come from diminishing the amenity-based economic model that continues to develop in the Ely area. We think both the positive and negative effects of such a mine would be concentrated in the Ely area. So, as residents in our region continue to debate the merits of Twin Metals’ proposal, the Timberjay is offering new data to the discussion, gleaned almost exclusively from government and academic sources.

We’ve reported in the past on the job creation estimates associated with the proposed Twin Metals mine, with current company estimates of 650 permanent jobs, with an average salary of close to $80,000 a year. That’s an estimated $52 million in annual income to mine workers living in the region. If 50 percent of those workers lived and shopped in Ely it would potentially inject up to $26 million in local income each year into Ely’s economy. That is the plus side of the ledger.

So what does the negative side of the ledger look like if, as critics of the mine fear, North Country enthusiasts choose to look elsewhere to invest in new homes and seasonal cabins should a new mine impact the local environment and the culture of Ely? A new mine could bring $26 million in annual income to local residents. Could it also lead to the loss of existing or future local income if new investment in surrounding townships slows and some current residents choose to leave the area, taking their incomes with them? And, if so, how much?

To better understand this issue, and assess the potential downside risks of copper-nickel mining to Ely’s economy, it is important to understand the townships that surround Ely, and how they differ (often significantly) from the city itself. The four townships we examined were: Eagles Nest, Fall Lake, Morse, and Stony River.

The townships differ from Ely in several ways, including: average annual income, housing stock growth, total property valuation, and views on mining. We’ll look at the data on each of these topics. We’ll also offer potential conclusions to better assess the level of economic risk that copper-nickel mining poses to the Ely area economy.

Household income

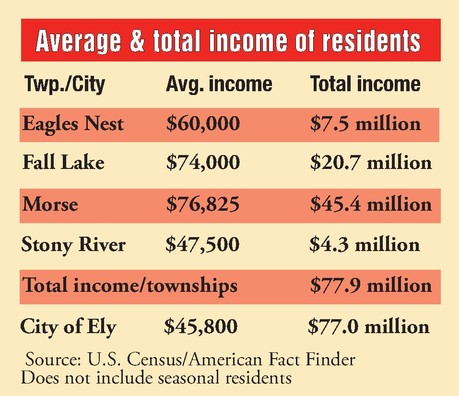

The income divide between the city of Ely and its surrounding townships is significant. According to the most recent census data, the average household income in the four townships is as follows:

‰ Eagles Nest: $60,000

‰ Fall Lake: $74,000

‰ Morse: $76,825

‰ Stony River: $47,500

Note that we used the mean, or average, rather than the median household income, because our goal was to determine total income to residents of each township, which is best determined by multiplying the average household income times the number of households.

Using this calculation, we can determine that year-round residents of the four townships earn approximately $77.8 million annually, which represents income available for economic activity within the Ely area economy. The mean household income in the city of Ely is $45,800. Using the same calculation for the city of Ely, with 1,681 total households, you get $76.98 million in annual income. These calculations demonstrate the importance of the townships in generating income to the Ely area economy.

But this only tells part of the story, because it does not consider the impact of seasonal recreational property owners, who outnumber permanent residents of the townships by roughly two-to-one, and who spend a significant portion of their annual income in the Ely area as well.

Determining the annual household income of seasonal residents and other recreational property owners in the area is not possible, but we can assume it is greater than the average income for permanent residents, since most of these property owners are living in urban areas where incomes tend to be greater. For the purposes of our analysis, we assumed that seasonal and recreational property owners earned 25 percent more than year-round residents (which we believe is conservative).

We also assumed that seasonal and recreational property owners utilized their residences an average of six weeks a year, and spent 20 percent of their income on living expenses while in the area or on maintenance, utilities, insurance, and other expenses related to their seasonal residence, many of which are incurred year-round.

Adding seasonal recreational income on this basis adds $31.37 million to the total available for economic activity in the Ely area. We recognize some of that season recreational property is owned by residents of Ely proper, and we are deducting ten percent to account for that, giving a grand total of added income to the area of $28.3 million.

This leaves a grand total of $106 million in annual income generated by residents in the townships, compared to $76.98 million generated by residents of Ely.

Growth in housing

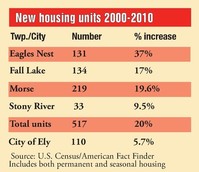

While growth in housing is relatively modest throughout northern St. Louis County, it is relatively robust in three of the four townships surrounding Ely, and seasonal residences dominate the new construction. We compared census data from 2000 and 2010, and during that decade the four townships saw the following growth in housing stock:

Eagles Nest: 27 percent overall, 26 percent in seasonal recreational.

Fall Lake: 14 percent overall, 22 percent in seasonal recreational.

Morse: 16 percent overall, 21 percent in seasonal recreational.

Stony River: Two percent overall, 11 percent in seasonal recreational.

By contrast, Ely experienced five percent growth in housing stock over the decade. That means Ely added 110 new housing units over the decade, or an average of 11 new units annually. The townships, by contrast, added 517 units over the same period, or just under 52 per year. For those sectors reliant on housing stock growth, such as construction, building supplies, excavators, well drillers, finance, insurance, home furnishings, the housing growth in Eagles Nest, Morse, and Fall Lake townships is a critical element of Ely’s economy.

Assuming a relatively conservative average overall construction price of $150,000 for a new housing unit in the townships, this sector alone would inject $7.8 million annually into the Ely area economy.

Views on copper-nickel mining

At last week’s scoping hearing on the proposed federal mineral withdrawal, Ely Mayor Chuck Novak claimed that 68 percent of the residents of Ely supported a new mine. Other data would tend to support that figure, within the city itself.

It is a much different story, however, in the townships, where the evidence points to majority or near-majority opposition to a new mine among permanent residents.

Consider the results of the 2015 DFL special election primary, which pitted three pro-copper mining DFLers against a candidate, Bill Hanson, who took a strong position against it. In a normal race, Hanson, who hails from Grand Marais, would have been unable to mount a strong bid in the Ely area, particularly with an Ely area candidate also in the race. But Hanson’s position on mining enabled him to significantly outperform expectations in the townships. While Hanson garnered 23 percent of the vote in the city of Ely, he won 56 percent of the vote in the four-way race in Fall Lake, 57 percent in Eagles Nest, 62 percent in Stony River, and was the top vote-getter (albeit narrowly) in Morse, with 37 percent of the vote.

Such vote totals reflect the views of permanent residents, whereas there is general agreement in the area that the views of seasonal residents are even more strongly opposed to copper-nickel mining than these vote totals would suggest.

A 2014 survey of attitudes in the four townships paints a similar picture. The survey, completed by researchers from the University of Minnesota-Morris, enjoyed a strong rate of response from those who received the survey.

It asked, among other things, what qualities attracted township residents to the area. The vast majority cited their proximity to nature, outdoor recreational opportunities, solitude, and peace and quiet as the primary factors that keep them in the region.

When asked what factors would make them consider leaving the area, the single largest factor (named by 23 percent of respondents) was mining. Based on this data, it is apparent that a significant divide in views on copper-nickel mining exists between residents of the city of Ely and residents of neighboring townships.

Property valuation

Differences between the city of Ely and the four townships in terms of property valuation are equally stark. Morse and Fall Lake townships are among the highest value townships in northern Minnesota, with total estimated market value of $414 million and $345 million respectively. Eagles Nest Township’s 2017 valuation is $109 million, while Stony River’s valuation is $88 million. That’s a combined valuation of $956 million.

The valuation of all property within the city of Ely, by contrast, is $164.5 million.

Economic studies have demonstrated that proximity to a mine, or other developments considered undesirable to most residential property owners, can negatively impact property values.

What does it mean?

The data presented here could support differing interpretations and predictions of the future, but several conclusions are well justified. They include:

• Collectively, both permanent and seasonal residents of the townships provide roughly six of every ten dollars of locally-based income available to generate economic activity in Ely.

• Collectively, the townships account for 82 percent of new housing construction activity in the Ely area. They provide an overwhelming amount of the real estate activity as well.

• While the permanent populations of the townships are currently static, the overall population of both permanent and seasonal residents is growing modestly in three of the four townships (Stony River being the exception). If that trend continues, it would continue to provide for income growth in the Ely area, resulting both from annual construction wages as well as from spending from growth in the overall number of seasonal residents.

• Majorities of both year-round and seasonal residents of the townships would view copper-nickel mining in the Ely area as a significant and negative development that could prompt a significant percentage to consider leaving the area. How large a percentage is unknown, and that presents an economic risk associated with a mining proposal.

• The sluggish pace of new housing construction in Stony River township from 2000-2015, which was a period during which mineral exploration activity was intense in the township, may reflect future conditions in other townships, particularly Fall Lake, were copper-nickel mining to commence.

• Should 15 percent of current township residents choose to leave the area or visit seasonal homes less frequently due to mining, it would lead to an initial loss of $15.9 million in annual income to the Ely area economy. Should 20 percent of township residents choose to leave or visit less frequently, it would lead to an initial loss of $21.2 million. Recall that based on the township survey, 23 percent said that mining was a factor that could prompt them to leave the area. As the recent study led by economist Spencer Phillips noted, approximately 42 percent of residents of the region rely on investment income and transfer payments, such as Social Security for their income, which leaves them much freer to leave an area if the attributes that currently keep them in the area are lost or impaired.

It is likely that most of these individuals would choose to sell their properties, many of which would be purchased by others, very possibly by new or existing residents working in a new mining operation. But substituting one income for another maintains the economic status quo. It does not generate economic growth. Given that average incomes for township residents are relatively high, replacing current township residents with future miners provides little gain in overall local income.

• The potential losses in local income would compound with time due to lost growth. From 2010-2015, according to census data, average income in Morse and Fall Lake Townships increased by 3.2 percent annually, which added approximately $2.1 million per year in local income to the Ely area without accounting for the impact of new seasonal residents investing in, and spending time in, the townships. By contrast, incomes for Ely residents have remained static over the past five years, according to census data. It is reasonable to conclude that the economic importance of the townships to the Ely area economy would continue to increase over time, barring a development that discourages new investment in the townships and slows or halts the increase in township incomes due to the loss of high earners who choose to leave the area. This could be considered an “opportunity cost” of mining, as the Ely area loses income gains that township residents might otherwise accrue.

• The introduction of mining would likely have a considerable negative impact on future growth in seasonal recreational real estate purchases and housing unit construction in the townships. That appears to already be happening in Stony River Township due to the impact of intensive mineral exploration there. The start-up of mining, on the other hand, may increase housing construction within the city of Ely, which could partially offset a decline in construction in the townships.

• Based on consistent historical trends, overall local wage income derived by residents employed in a copper-nickel mine would tend to decline over time given increasing mechanization and productivity gains. For example, it required four times as many mine workers in 1979 to produce the same tonnage of taconite as is produced on the Iron Range today. Economists project that the pace of mechanization will only increase, leading to less overall wage income generated by any operating mine over time.

•Stability versus boom and bust. The amenity-based economic model that is well-established in Ely’s townships provides a relatively robust, predictable, and steadily growing source of income to local residents that generates activity within the local economy. A copper-nickel mine would provide a robust source of local income during boom years, but would provide significant economic stress during the cyclical downturns inherent in the mining industry. Mining busts create significant economic dislocation and hardship in mining-dependent communities. That is a conclusion well supported by historical data.

Impact of lost tourism

None of this analysis considers potential impacts to what is typically called the tourism economy, which focuses on income generated through visits by non-residents. A recent study that looked solely at income generated by outside visitors utilizing the Boundary Waters Canoe Area Wilderness, concluded that the wilderness generated about $57 million in annual income to the communities of Ely, Tofte, and Grand Marais. Were negative perceptions about copper-nickel mining within the wilderness to affect visitation, the costs would almost certainly be focused in the Ely area, where the effects of the mine would be most pronounced. Conservatively, 50 percent of wilderness visits emanate from Ely.

Were wilderness visits beginning from Ely area accesses to decline by 25 percent due to negative perceptions of sulfide mining within the wilderness watershed, it would result in the loss of more than $7 million in annual local income. Keep in mind that wilderness visits comprise only a portion of the total visitor spending in Ely. The total impact on visitor spending could be significantly greater than $7 million annually.

Conclusions

While the opening of a copper-nickel mine near Ely would provide a significant new source of local income to the community, it would not come without significant economic risks, which could offset or even exceed the benefits of a mining venture.

Based on this analysis, it is reasonable to assume that the opening of a mine could lead to the initial loss of anywhere from $22.9 million to $28.6 million in local income, a figure that would likely increase over time.

This assumes losses based primarily on public perception of the loss of wilderness attributes in the Ely area. Significant documented environmental impacts, a major spill, or a catastrophic event, such as a tailings basin breach, could significantly increase the downside risks to the Ely area economy.